The study of economics, particularly in the context of Singapore, is a venture into understanding the intricacies of financial systems, market dynamics, and the factors influencing economic stability. In this essay, we delve into a critical aspect of economic analysis — inflation — and explore the major causes of inflation in the specific context of Singapore. As we navigate through the economic landscape of this thriving nation, it becomes evident that inflation is not merely a numerical phenomenon but a complex interplay of various economic forces.

Understanding the Basics: What Is Inflation?

Before delving into the causes of inflation in Singapore, it is crucial to establish a foundational understanding of the term itself. Inflation is a quantitative measure of the rate at which the general price level of goods and services in an economy rises over a specified period. It signifies a decrease in the purchasing power of a nation’s currency, expressed as a percentage. In contrast, deflation occurs when prices experience a decline.

Several key points elucidate the concept of inflation:

- Purchasing Power Erosion: Inflation results in a reduction of the purchasing power of a country’s currency. This implies that the same amount of money can buy fewer goods and services than it could in the past.

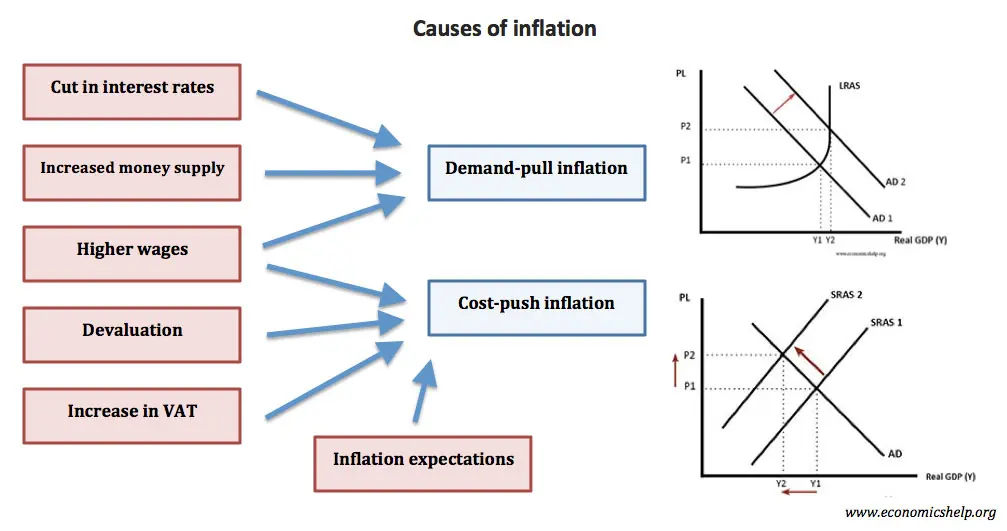

- Types of Inflation: Inflation is categorized into three main types — Demand-Pull inflation, Cost-Push inflation, and Built-In inflation. Each type has distinct causes and implications for the economy.

- Measurement through Indices: Commonly used indices to measure inflation include the Consumer Price Index (CPI) and the Wholesale Price Index (WPI). These indices provide insights into the overall price movements of consumer goods and wholesale products.

- Economic Impact: The effects of inflation can be perceived positively or negatively depending on individual perspectives. While those with substantial assets may benefit from inflation as it raises the value of their holdings, individuals holding cash may experience a decline in the value of their monetary assets.

Inflation Rate in Singapore: A Macroscopic View:

Singapore, a thriving economic hub, has witnessed fluctuations in its inflation rate over the years. In 2018, the average inflation rate stood at approximately 0.44 percent compared to the previous year. This marked a recovery from the negative trend experienced in 2015 and 2016. The resilience of Singapore’s economy allowed it to bounce back and maintain its status as one of the leading economies in the East.

The causes of inflation in Singapore are multifaceted, influenced by both domestic and global factors. Analyzing the inflation rate in Singapore is crucial for understanding the economic landscape and formulating effective policies to manage inflationary pressures.

Major Causes of Inflation in Singapore: Unraveling the Complex Web:

In times of economic challenges, the question arises: What causes inflation? The answer to this question involves a nuanced exploration of global factors, domestic policies, and their impact on demand, supply, prices, and production. Several factors contribute to inflation in Singapore, and a comprehensive analysis is essential for devising effective economic strategies.

- Global Factors and Demand-Supply Dynamics: Singapore’s economy is intricately linked to global trade, and external factors play a pivotal role in shaping its economic trajectory. Fluctuations in demand for high-tech products and unforeseen global events can disrupt the delicate balance of supply and demand, influencing prices and production.

- Economic Growth and Population Growth: The high growth of Singapore’s population and its robust economic development contribute to inflationary pressures. Economic expansion, while a sign of prosperity, can strain resources and lead to an increase in prices.

- Taxation Policies and Transportation Costs: Changes in taxation rates and an increase in transportation costs are significant contributors to inflation. These factors directly impact the cost structure of goods and services, influencing their final prices.

- Open-Door Immigration and Consumer Prices: Singapore’s open-door immigration policy has demographic implications, affecting the labor market and consumer prices. As immigration contributes to population growth, it can influence demand and supply dynamics, thereby impacting inflation.

- Government Initiatives and Economic Recovery: Fiscal stimulus measures adopted by the government to initiate economic recovery can have repercussions on inflation. While these initiatives may spur growth, they also introduce additional money into the economy, potentially leading to inflationary pressures.

- Disease Outbreaks and Global Events: Unforeseen events, such as disease outbreaks or global recessions, can have profound effects on Singapore’s economy. The outbreak of respiratory illnesses, such as SARS, disrupted trade and tourism, impacting the nation’s income and contributing to inflationary challenges.

Inflation Control Strategies: Navigating the Economic Terrain:

In the complex realm of economics, managing inflation requires a strategic approach. Both monetary and fiscal policies play pivotal roles in curbing inflation and maintaining economic stability. The following strategies are employed to mitigate inflationary pressures:

- Monetary Measures: Adjusting interest rates is a key monetary tool to control inflation. By increasing interest rates, the central bank can influence the money supply, encouraging saving over spending and reducing inflationary pressures.

- Fiscal Policies: Fiscal measures, including changes in taxation rates and government spending, can impact inflation. Decreasing taxation rates and implementing deregulation initiatives are examples of fiscal policies that aim to reduce inflation.

- Supply-Side Initiatives: Enhancing long-term competitiveness and productivity through supply-side initiatives is crucial for addressing inflation. Policies that promote efficiency, innovation, and resource utilization contribute to sustainable economic growth.

- Exchange Rate Policies: Governments may implement exchange rate policies to influence the value of their currency. This, in turn, can impact inflation rates, especially in nations with high dependence on exports.

Conclusion: Navigating the Economic Landscape:

In conclusion, understanding the major causes of inflation in Singapore requires a comprehensive exploration of global and domestic factors shaping the nation’s economic trajectory. Singapore’s resilience in the face of challenges, coupled with proactive government policies, has allowed it to navigate through periods of inflation.

The recent rise in inflation, while notable, has been effectively managed through a combination of strategic measures. The government’s initiatives, including price control policies, rationalization of local industries, and wage adjustments, have contributed to easing inflationary pressures. As Singapore’s economy continues to evolve, addressing inflation remains a critical aspect of sustaining growth and stability.

In the broader context, this exploration of the major causes of inflation in Singapore serves as a testament to the interconnectedness of global economies and the intricate web of factors influencing economic dynamics. It underscores the importance of a nuanced understanding of economic principles and the implementation of effective policies to ensure sustained prosperity.